From Core to Conversion: Personalized Marketing That Works

Trusted by leading credit unions and community banks

Build an intelligent marketing and growth engine

Core Connected Marketing bridges the data gap between your financial institution’s core banking system and HubSpot so you can stop marketing in the dark. When core data lives in one place and marketing lives in another, personalization becomes manual, reporting is incomplete, and teams lose time to spreadsheets. We connect the systems so HubSpot can act on real member signals and you can deliver smarter journeys, sharper segmentation, and clearer performance visibility.

-

New Member Onboarding

Problem

Generic welcome emails treat every new member the same, whether they joined online like Sarah or in-branch like Mike.

With Core Connected Marketing

Sarah receives a 120-day trust-building series aligned to her digital onboarding. Mike gets an immediate digital adoption push aligned to his in-branch start.Outcome

Onboarding completion rates increase -

Cross-Sell at the Right Time

Problem

When credit card offers are triggered solely by a new checking account, timing is often off and the offer feels irrelevant.With Core Connected Marketing

After direct deposit is active and external credit card payments are detected, HubSpot can trigger a credit card offer when the member is most likely to act.Outcome

Credit card acceptance rates increase. -

Retention & Win-Back

Problem

When credit card offers are triggered solely by a new checking account, timing is often off and the offer feels irrelevant.With Core Connected Marketing

After direct deposit is active and external credit card payments are detected, HubSpot can trigger a credit card offer when the member is most likely to act.Outcome

Credit card acceptance rates increase -

Mortgage & Loan Campaigns

Problem

Mortgage campaigns often rely on broad lists and generic timing, so members hear from you too early, too late, or not at all.With Core Connected Marketing

When a member starts showing mortgage intent, like researching rates, increasing savings, or changing payment behavior, HubSpot can trigger timely education and outreach based on real signals, not guesswork.Outcome

Lead quality increases, cost per lead decreases

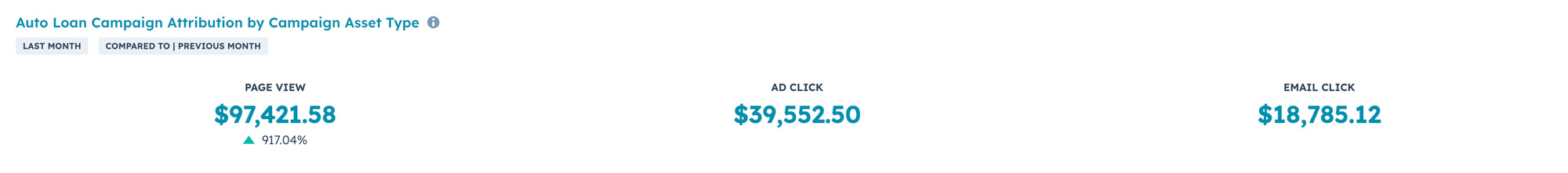

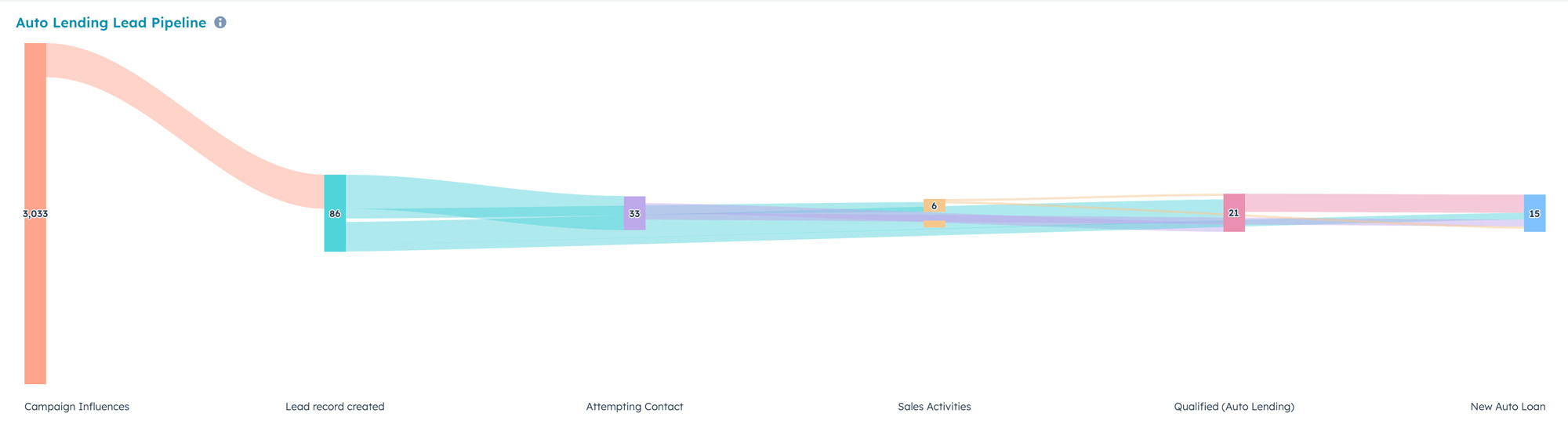

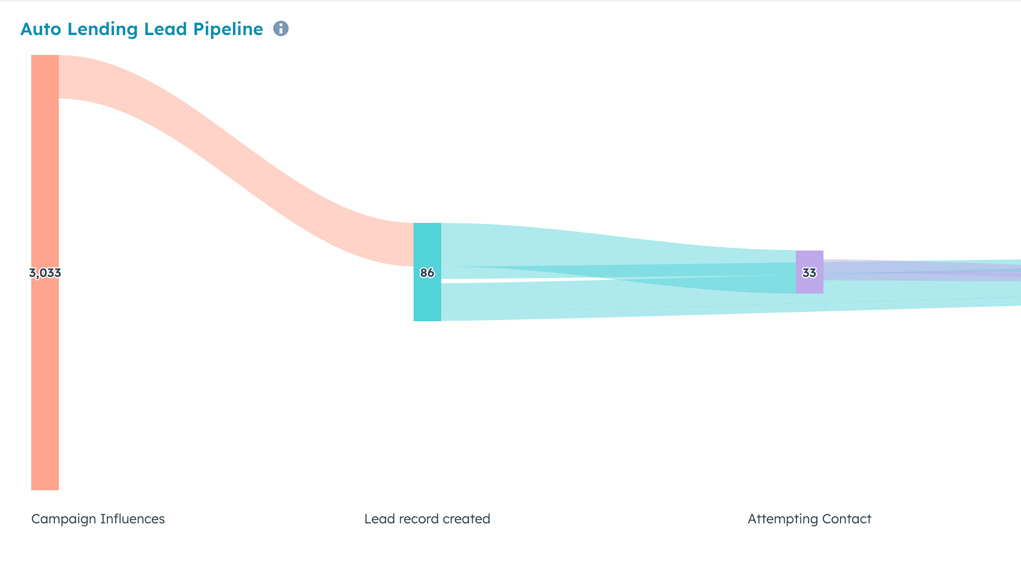

With Core Connected Marketing, you can literally see the impact your marketing efforts have on results.

Build reports using HubSpot that let you see metrics at every stage of the pipeline from your campaign influence to your final conversions.

Real People. Real Results. Real Talk.

Core Connected Marketing completely changed that. Now, our journeys are behavior-based, our lead alerts are timely and actionable, and we can finally show attribution for campaigns that drive real results. The integration was fast, secure, and required no heavy lifting from our internal IT team.

It is the first time marketing, sales, and digital are working in sync, and our leadership can clearly see the value.”

Clint Stucky

Purpose-Built to Power Your Marketing.

| Feature | Core Connected Marketing | Without Core Integration |

|---|---|---|

| Sync Frequency | ||

| HubSpot Native | ||

| Implementation Time | ||

| Core System Changes | ||

| Security Model | ||

| Marketing Expertise |

Security Baked into HubSpot

As a HubSpot Platinum Solutions Partner, we prioritize security, ensuring that your data remains protected and secure.

For Chief Marketing Officers

Perfect timing! We can help you implement HubSpot and Core Connected Marketing together, ensuring your marketing automation is intelligence-powered from day one. We're HubSpot Solutions Partners and specialize in financial institution deployments.

FAQs

For Chief Information Officers

We use read-only API access to your core system, meaning zero write permissions and zero risk of data corruption. All data transmission is encrypted, we're SOC 2 Type II certified, and we maintain comprehensive audit trail logging. Your core system security posture doesn't change.

FAQs

For Chief Executive Officers

FAQs

For Marketing Operations

Ready to Bridge the Gap?

From Start to Smart in 12 Weeks

Secure

Connection

Data

Mapping

Marketing

Activation

Meet Nikki Doherty, a sophisticated marketer that comes to Epicosity with over two decades of experience in the financial sector. She's been instrumental in the development of Core Connected Marketing, and is waiting to show you the power it can bring to your organization.

No credit card required • No sales pressure • Just a conversation about your specific challenges

.jpeg?width=1024&height=1024&name=Image%20(6).jpeg)